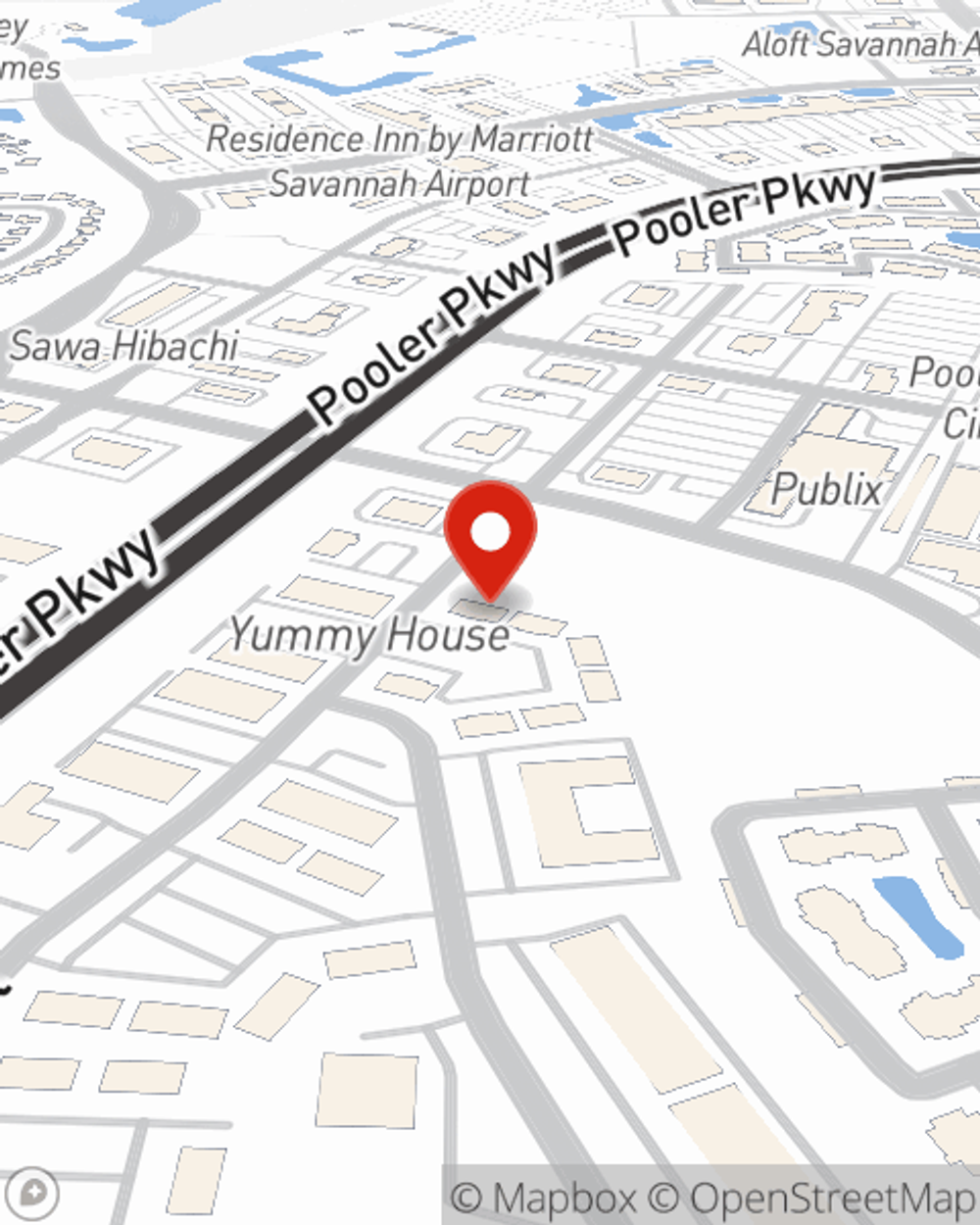

Life Insurance in and around Pooler

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

- Pooler, Ga

- Savannah Quarters

- Southbridge

- Guyton, GA

- Effingham County

- Columbia, SC

- Atlanta, GA

- Summerville, SC

- College Park, GA

- Statesboro, GA

- Pembroke, GA

Check Out Life Insurance Options With State Farm

Young people often assume they don’t need life insurance right now. Actually, it’s the opposite! You miss out on lots of benefits by waiting. That’s why your Pooler, GA, friends and neighbors of all ages already have State Farm life insurance!

Life goes on. State Farm can help cover it

What are you waiting for?

Why Pooler Chooses State Farm

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with meeting the needs of children, life insurance is strictly vital for young families. Even if you're a stay-at-home parent, the costs of paying for daycare or housekeeping can be significant. For those who don't have children, you may be planning to have children someday or have aging parents who rely on your income.

As a commited provider of life insurance in Pooler, GA, State Farm is ready to be there for you and your loved ones. Call State Farm agent Sam Sharpe today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Sam at (912) 748-7300 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.